What is an IRA?

Banking IRAs (Individual Retirement Accounts) refer to retirement savings accounts that are offered by banks. These accounts are designed to help individuals save for their retirement while benefiting from the security and convenience of a bank.

Here are some key points about Banking IRAs:

- Retirement savings

- Traditional IRAs

- Roth IRAs

- FDIC insured

- Investment options

- Contribution limits

- Required minimum distributions

Save for your tomorrow with ease

Determine the type of account you need based on your banking requirements.

Contributions

Choose how much you want to contribute every month or week or even choose to add as you save.

Rollovers

Look forward to amazing interest rates with us as your bank.

Transfers

Free transfers internationally at the click of a button - send your money anywhere in the world.

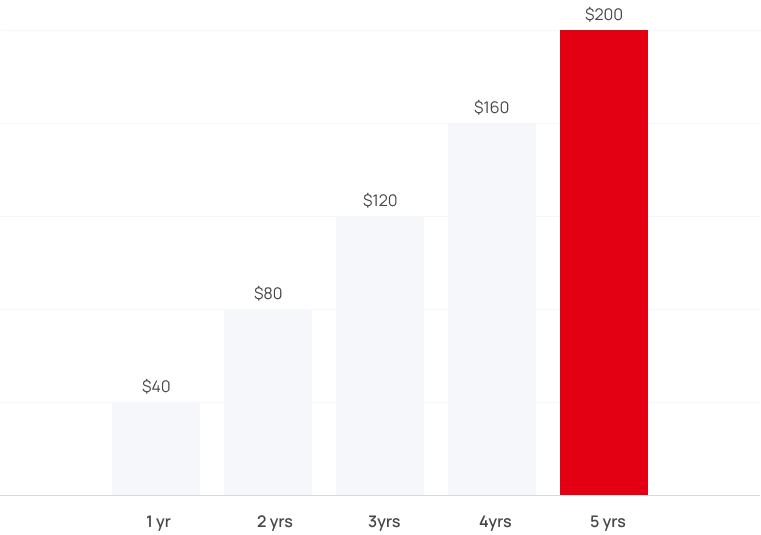

Account interest rate

Total interest earned

Interest rate calculator

A beautiful solution to your future leisure time

Investment IRAs

Bank Choose how much you want to invest and how to hold your investments - in a Stocks and Shares ISA or a General Investment Account. Choose from five ready-made funds, from defensive to adventurous.

We keep fees low so you keep more of any money you make. Keep track, add more money, and set up or change monthly payments whenever you like with 24/7 online access.

Savings IRAs

ISA stands for individual savings account. A stocks and shares ISA is a tax-friendly way to invest in the stock market, through funds or stocks and shares.

You’re taking some risk with your money in the hope it’ll grow more than if it was tucked away in the bank (or under the mattress). How much – or even if – it grows depends on the risk you’re willing to take, the investments you choose and how they perform. The current ISA allowance is $20,000 for each tax year.

Checking account FAQs

Credit cards offer a convenient and widely accepted method of payment for goods and services, both online and in physical stores. Credit cards also offer various benefits and rewards programs, such as cashback.

Credit cards offer a convenient and widely accepted method of payment for goods and services, both online and in physical stores. Credit cards also offer various benefits and rewards programs, such as cashback.

Credit cards offer a convenient and widely accepted method of payment for goods and services, both online and in physical stores. Credit cards also offer various benefits and rewards programs, such as cashback.

Credit cards offer a convenient and widely accepted method of payment for goods and services, both online and in physical stores. Credit cards also offer various benefits and rewards programs, such as cashback.

Credit cards offer a convenient and widely accepted method of payment for goods and services, both online and in physical stores. Credit cards also offer various benefits and rewards programs, such as cashback.

Credit cards offer a convenient and widely accepted method of payment for goods and services, both online and in physical stores. Credit cards also offer various benefits and rewards programs, such as cashback.

Credit cards offer a convenient and widely accepted method of payment for goods and services, both online and in physical stores. Credit cards also offer various benefits and rewards programs, such as cashback.

Credit cards offer a convenient and widely accepted method of payment for goods and services, both online and in physical stores. Credit cards also offer various benefits and rewards programs, such as cashback.

Credit cards offer a convenient and widely accepted method of payment for goods and services, both online and in physical stores. Credit cards also offer various benefits and rewards programs, such as cashback.

Credit cards offer a convenient and widely accepted method of payment for goods and services, both online and in physical stores. Credit cards also offer various benefits and rewards programs, such as cashback.

Latest IRA banking news

Cautious by name, cautious by nature. The lowest risk choice out of our three growth approaches, aiming for modest returns. Our experts invest your money globally to give it more chances to grow and to spread the risk. They use Environmental, Social and Governance (ESG) considerations to help select what to invest in.